CALENDAR 2021 IS FINISHING STRONG AND AS POST-LOCKDOWN RECOVERY TAPERS OFF AND CONDITIONS NORMALISE, IT SEEMS THE MOMENTUM WILL CONTINUE FOR SOME TIME.

BY ALAN OSTER, GROUP CHIEF ECONOMIST, NAB

AFTER A SHARP fall in growth in the third quarter of 2021, we expect to see a significant rebound in the last quarter. Our data suggests the latest lockdown had about half the impact of the lockdown that started in mid-2020, so a third quarter fall in growth of about -3.8% looks probable, followed by a jump of about 3% in the fourth quarter. We forecast strong growth to continue into early 2022, such that GDP in the second quarter will match that of one year prior. We also expect labour-market participation to normalise and unemployment to continue its path south.

We expect annual growth of about 1.5% in 2021 before a solid rebound to 4.0% in 2022 and normalisation to about 2.5% in 2023. More importantly, we see unemployment declining to about 4.2% in 2022 and 3.8% in 2023 – the lowest level in more than a decade. The state of the labour market is somewhat mixed. Demand is at a critical high, with labour shortages particularly apparent in industries such as wholesale, construction, manufacturing and agriculture. There are also reported shortages in some professions, including technology-related sectors.

Our business surveys indicate moderate upward pressure on wages. That said, the Reserve Bank of Australia has highlighted reports that indicate some shortages are related to employers refusing to pay higher wages. We generally expect wage pressure to rise to about 2.7% at the end of 2021, which will be followed by some easing in 2022 as supply difficulties decrease and international arrivals increase. Wage growth should stabilise by the end of 2022 and increase to above 3% by the end of 2023.

That said, there are big differences in wage growth across industries, as highlighted by our October Business Survey, which indicates that wholesale, construction and manufacturing are showing more signs of wage rises than other sectors. Purchase costs are also a problem for some industries. The third quarter 2021 price inflation data was an upward surprise in core terms. The core measures increased by about 0.7 percentage points and returned the inflation rate to the bottom of the RBA’s 2–3% target range for the first time since 2015. It looks like core inflation will increase a touch higher (to, say, 2.3%) by mid-2022. Thereafter, an easing in supply-side pressures and the reopening of international borders may help, but the core rate of inflation would still move higher — with wages growth — in 2023. In brief, we see the current price rises as temporary; however, markets have reacted aggressively and have priced three rate rises into 2022.

We suspect the RBA will also view the increases in core inflation as temporary. However, it will be mid-2022 before we can be sure, one way or the other. The key point is that our forecasts remain around the bottom of the target range before accelerating into 2023. We see the outlook for increased inflation as possibly bringing the timing of rate rises forward, with mid-2023 now looking likely. Indeed, we recently brought forward the timing of our expected rate increase to mid-2023 (it was previously early 2024). Also, the RBA recently stepped away from yield curve control out to early 2024. We see quantitative easing finishing by February 2022 (brought forward from mid-2022).

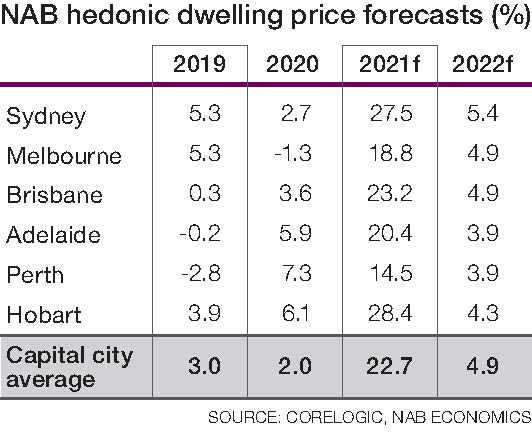

Turning to house prices, we recently published new forecasts for 2021 and 2022. Basically, we see house prices up about 25% in 2021 and about 5% in 2022. When we include unit prices, the numbers show about 23% price growth in 2021 and 5% in 2022. Finally, on macroprudential tools, the increase of the loan serviceability buffer to 3% has operated from November 1, 2021; hence, it is unlikely to have an impact until March 2022. The Australian Prudential Regulation Authority has promised to put out a special report by year’s end. If more prudential controls are to come, we’ll most likely see them then. There could be further increases in the buffer and/or limits on debt-to-income ratios. The latter would have a much larger potential impact.

On the outlook for housing credit, there was an increase of about 6.2% in the year to September 2021, and we see more like 4.6% by September 2022. The main impact will be on owner-occupied housing credit, which could slow from the current 8.1% and be nearer to 6%. Investor credit will probably stay in the 2-3% range.

To watch the economic outlook and 2022 forecast presented by Alan Oster, Group Chief Economist NAB, click the video below:

The information contained in this article is gathered from multiple sources believed to be reliable as of the end of October 2021 and is intended to be of a general nature only. It has been prepared without taking into account any person’s objectives, financial situation or needs. Before acting on this information, NAB recommends that you consider whether it is appropriate for your circumstances. NAB recommends that you seek independent legal, property, financial and taxation advice before acting on any information in this article. ©2021 National Australia Bank Limited ABN 12 004 044 937 AFSL and Australian Credit Licence 230686